Increasing Productivity — Finding Opportunity In A Downturn

Canada’s oil, gas and mining industry is shedding tens of thousands of workers while Canadian manufacturers report that “finding the people they need is among their most pressing business challenges.”

Canada’s oil, gas and mining industry is shedding tens of thousands of workers while Canadian manufacturers report that “finding the people they need is among their most pressing business challenges.”

Commodities prices have fallen 25% over the last 12 months putting the energy sector under increasing pressure to slash costs while improving productivity. These converging issues hold an opportunity — but only if we’re willing to rethink and reset business practices.

Three questions merit attention:

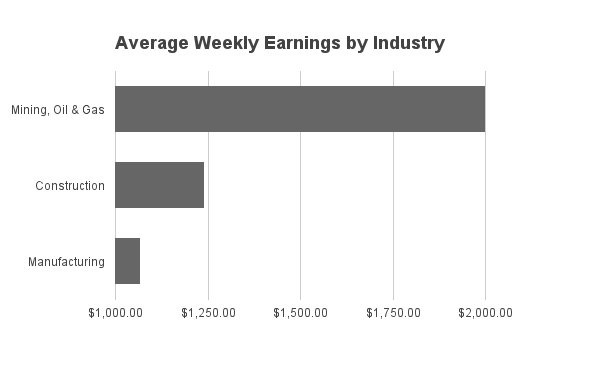

- With thousands of energy sector workers now looking for employment, can we bridge the gap between the almost 50% premium that oil, gas and mining pay for labour so that manufacturing can pick up the talent they need?

- Can oil, gas and mining pick up available talent at a cost structure closer to that of manufacturing?

- Are traditional models of employment the right fit for aging baby boomers and millennials who have smartphones growing out of their arms?

Closing the Wage Gap

On August 27, Statistics Canada reported that the average weekly wage for workers in mining, oil and gas are almost double that of manufacturing and over 35% higher than construction. These stats are based on direct weekly wages only; benefits, food, accommodation, transportation, and living out allowances further widen the gap.

We often hear from manufacturing companies that they are fearful of hiring laid off workers because they will return to oil and gas as soon as prices rebound. This is a legitimate fear. Some will leave but others will stay, choosing a more modest lifestyle with employment stability over the prospect of higher wages and another layoff. This is especially true if families relocate for the new job and roots are set down. Turnover will be minimized by the lingering memories of recent layoffs.

Employers can increase retention by understanding and clearly communicating the benefits of their openings and positive aspects of the local community. When interviewing potential new employees, ask what’s most important to them and their family.

Maintenance and Reliability Talent Needs Within Oil and Gas

One of the challenges expressed by energy sector employers is a need for increased attention on maintenance and reliability. In Syncrude’s performance overview (see Finance, Operations and Resource Management) the company reports an 11% shortfall of crude oil shipped, attributed to reliability and maintenance issues. Suncor’s annual report uses the word ‘reliability’ over 50 times and ‘maintenance’ more than 100 times. We see a similar emphasis from BC Hydro with 42 and 17 mentions, respectively. Should oil and gas companies wait for prices to rebound or is this an opportunity to hire newly-available talent specifically to fix maintenance and reliability problems?

Consider Temporary or Contract Workers

Contract or temporary work is an efficient and cost-effective option as your employment agency bears the increased costs when hundreds of applicants respond to a job ad. Payroll, benefits, Workers Compensation Board or Workplace Safety Insurance Board premiums, termination, and relocation costs can be contained. Management and some top contractors may require a living out allowance for a temporary position — which may be considered non-taxable, considerably helping the employees.

Specialized recruiters working with multiple employers and a broad candidate base have an advantage in that they know how to identify a company’s unique attractions and will highlight those features to secure the most qualified applicants.

Commodities prices have fallen over 25% in the past 12 months resulting in closed operations, deferred maintenance projects and expansion plans shelved indefinitely. Do companies just need to wait for prices to turn around or is this the time to reset and rethink what we have been doing?